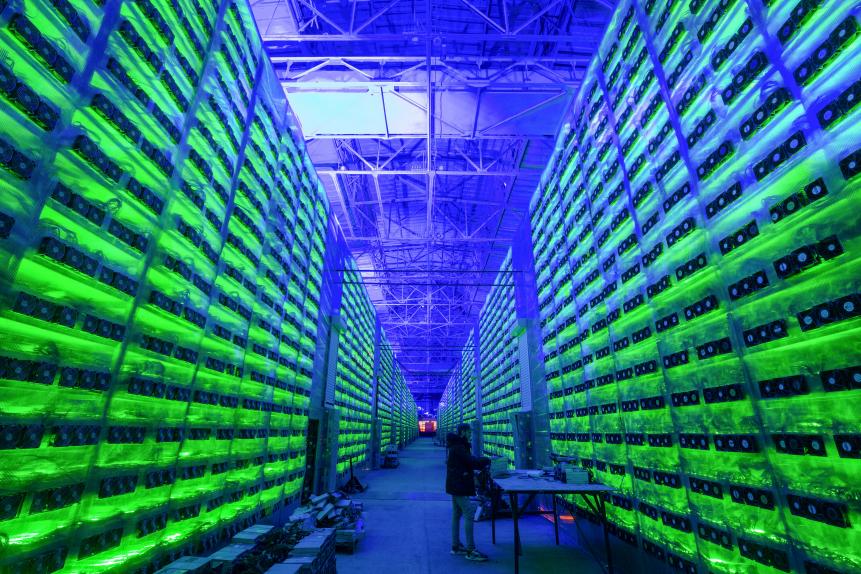

SOPA Images

Wild Climate Ride Expected as Cryptocurrency Popularity Fuels Power Consumption

Bitcoin’s wild speculation and surging popularity has caused scientists and economic analysts to rate the digital cryptocurrency as a danger to the environment. More than 60% of Bitcoin’s mining cost is in the electricity it uses. And as its value rises, so does the entire currency’s energy consumption and its potential impact on climate change.

The value of one Bitcoin rocketed past $60,000, in April 2021, while only six months earlier the price sat around $10,500. News of entrepreneur Elon Musk’s billion-dollar investment in Bitcoin and anticipation of popular uptake in digital currencies fueled these huge price rises. While investors made merry, the electrical energy used by the network doubled.

Bloomberg

A worker inspects hardware devices as illuminated mining rigs operate inside racks at the CryptoUniverse cryptocurrency mining farm in Nadvoitsy, Russia, on Thursday, March 18, 2021. The rise of Bitcoin and other cryptocurrencies has prompted the greatest push yet among central banks to develop their own digital currencies.

Digiconomist estimated Bitcoin’s global energy draw down at 106 terawatt hours (TWh) per year, equal to the power used by the Republic of Kazakhstan. The fact that Bitcoin’s consumption is rated on the country scale shows just how energy-intensive it has become–equivalent to a carbon footprint of just over 50 million tons of carbon dioxide (CO2) released annually.

Other sources, like the Cambridge Bitcoin Electricity Consumption Index, estimated its energy use even higher at around 125 TWh–somewhere between Norway and Argentina. Demand for the digital currency has pushed its power consumption higher than 159 nations, including Ireland, and environmental researchers think the emissions generated by Bitcoin alone could push global warming above 2 degrees Celsius (3.6 degrees Fahrenheit) within 30 years.

Mining Bitcoin requires dedicated computing equipment–high-end graphics cards or ASIC integrated circuits that process data at high speed–to solve the complex mathematical problems that create new coins. This is an energy-intensive process, so mining operations are often set up in regions where electricity is cheapest.

Chris McGrath

People use bank ATM"s next to a Bitcoin ATM machine at a shopping mall on April 16, 2021 in Istanbul, Turkey. Cryptocurrencies gained traction globally this week after cryptocurrency exchange Coinbase launched on the New York Stock Exchange.

China dominates global Bitcoin mining because of its abundance of cheap coal-fired electricity, a carbon-intensive ‘dirty’ energy source. Miners run their machines 24 hours a day to maximize profit, constantly adding to and updating them to earn more Bitcoin. “The miners usually dislike renewables because they don't generate electricity all the time,” said Alex de Vries of Digiconomist. “Green energy is a terrible match for Bitcoin.”

And yet the amount of renewable energy powering the blockchain is estimated at 39 per cent, or even higher, at a reported 73 percent—making Bitcoin mining more renewable energy-driven than almost any other large-scale industry.

Evidence of mining operations in places like Washington—fueled by abundant green hydroelectric energy, plus a rush to hydropower sites in China and geothermal power in Iceland—give Bitcoin stronger environmental credentials. Some in the cryptocurrency industry believe mining operations that don’t switch to renewable sources will simply be shut down.

Comparisons to the energy use of the global banking system make Bitcoin look even less of an environmental risk. Emissions from all the banking system’s employees, their data centers, ATM and Visa networks, international flights, conferences, office and local transport costs, gold mining and related activities are perhaps hundreds of times larger than Bitcoin’s.

In any case, the International Energy Agency, the predictions about Bitcoin rapidly pushing up global temperatures are implausible, and similar, in some ways, to dire warnings about the exponential rise of the internet and its impact on electricity usage. It did not materialize because of improvements in the energy efficiency of computing and data transmission networks.

Bitcoin does have issues. As a technology it is still in its infancy, yet it consumes just under one percent of global electrical energy. Intensive energy-use is built into its protocol, keeping it secure and making sure no one entity can control it. Mining is deliberately slow and difficult, requiring powerful and frequently updated computational equipment, which also impacts global microchip production.

Analysts believe a change to the way that Bitcoin and other cryptocurrencies are verified is urgently needed. Currencies that use less energy may eventually overtake Bitcoin. But the growing popularity of all-digital coins still presents a serious challenge to solving the complex problem of climate change.